The Dow Jones Industrial Average (DJIA), commonly referred to as the Dow, is one of the most widely recognized and closely watched stock market indices in the world. As a benchmark for the overall health of the US economy, the Dow Jones Industrial Average plays a significant role in shaping investor sentiment and influencing financial markets globally. In this article, we will delve into the world of the Dow Jones Industrial Average, exploring its history, composition, and significance in the world of finance.

A Brief History of the Dow Jones Industrial Average

The Dow Jones Industrial Average was first introduced on May 26, 1896, by Charles Dow, the co-founder of Dow Jones & Company. Initially, the index consisted of 12 industrial stocks, including companies such as General Electric, American Tobacco, and Procter & Gamble. Over the years, the Dow has undergone numerous changes, with companies being added and removed to reflect the evolving landscape of the US economy. Today, the Dow Jones Industrial Average comprises 30 of the largest and most influential companies in the US, including Apple, Microsoft, and Johnson & Johnson.

How is the Dow Jones Industrial Average Calculated?

The Dow Jones Industrial Average is a price-weighted index, which means that the stocks with higher prices have a greater influence on the overall index. The calculation of the Dow is relatively simple: the sum of the prices of all 30 stocks is divided by a divisor, which is adjusted periodically to account for stock splits, dividends, and other corporate actions. This divisor ensures that the index remains consistent over time, allowing for accurate comparisons between different periods.

Components of the Dow Jones Industrial Average

The 30 companies that make up the Dow Jones Industrial Average are selected by the Dow Jones Index Committee, which considers factors such as market capitalization, liquidity, and industry representation. The components of the Dow are diverse, spanning a range of sectors, including technology, healthcare, finance, and consumer goods. Some of the most well-known companies in the Dow include:

Apple (AAPL)

Microsoft (MSFT)

Johnson & Johnson (JNJ)

Procter & Gamble (PG)

Coca-Cola (KO)

Why is the Dow Jones Industrial Average Important?

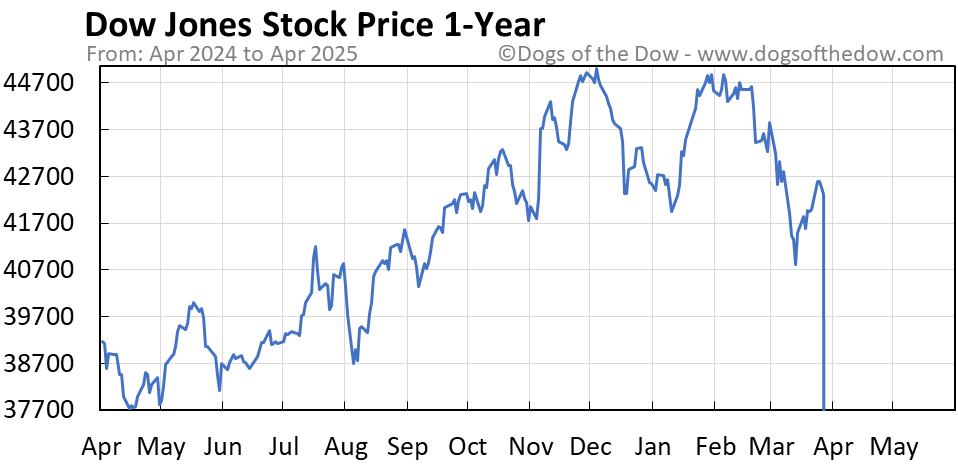

The Dow Jones Industrial Average is widely regarded as a benchmark for the overall health of the US economy. As a closely watched indicator, the Dow can have a significant impact on investor sentiment and market trends. A rising Dow can indicate a strong economy, while a falling Dow can signal a downturn. Additionally, the Dow is often used as a benchmark for investment performance, with many mutual funds and exchange-traded funds (ETFs) tracking the index.

In conclusion, the Dow Jones Industrial Average is a vital component of the global financial landscape, providing a snapshot of the US economy and influencing investor sentiment worldwide. Understanding the history, composition, and significance of the Dow can help investors make informed decisions and navigate the complexities of the stock market. Whether you're a seasoned investor or just starting out, the Dow Jones Industrial Average is an essential tool for anyone looking to stay ahead of the curve in the world of finance.

By following the Dow Jones Industrial Average, investors can gain valuable insights into the performance of the US economy and make informed decisions about their investment portfolios. As a leading indicator of market trends, the Dow is an essential tool for anyone looking to succeed in the world of finance. With its rich history, diverse components, and significant influence, the Dow Jones Industrial Average remains an indispensable part of the global financial landscape.