Table of Contents

- Rmd Table 2018 Excel | Elcho Table

- Beneficiary Ira Mandatory Distribution Table | Elcho Table

- Ira Minimum Distribution Table 2017 | Review Home Decor

- Inherited Ira Rmd Table 2018 | Elcho Table

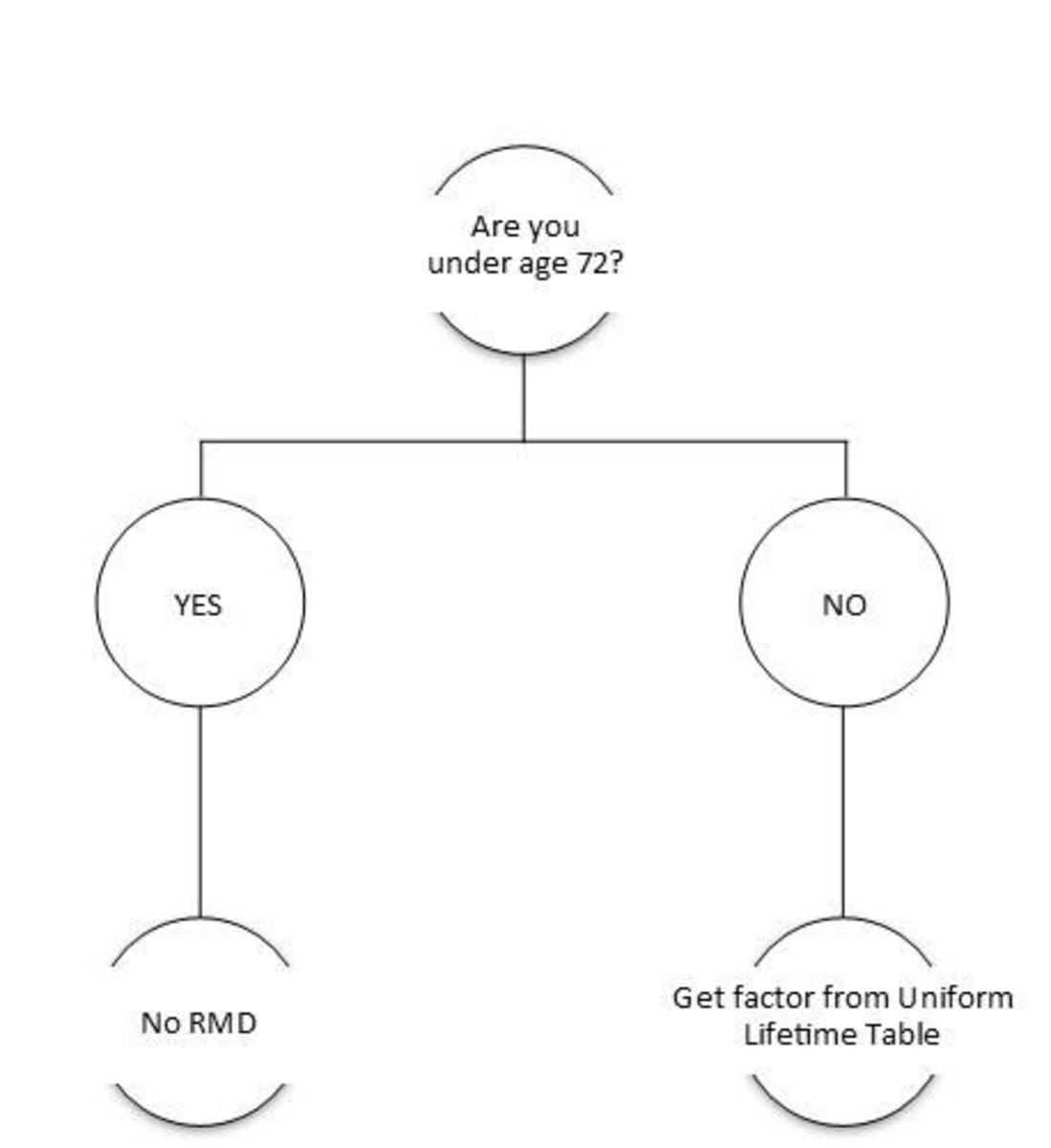

- What are Required Minimum Distributions (RMDs)?

- Irs Uniform Lifetime Table Excel | Cabinets Matttroy

- Required Minimum Distribution Table For Inherited Ira | Elcho Table

- Irs Gov Ira Required Minimum Distribution Table | Elcho Table

- inherited ira distribution table | Brokeasshome.com

- Ready to Retire - Really!: November 2015

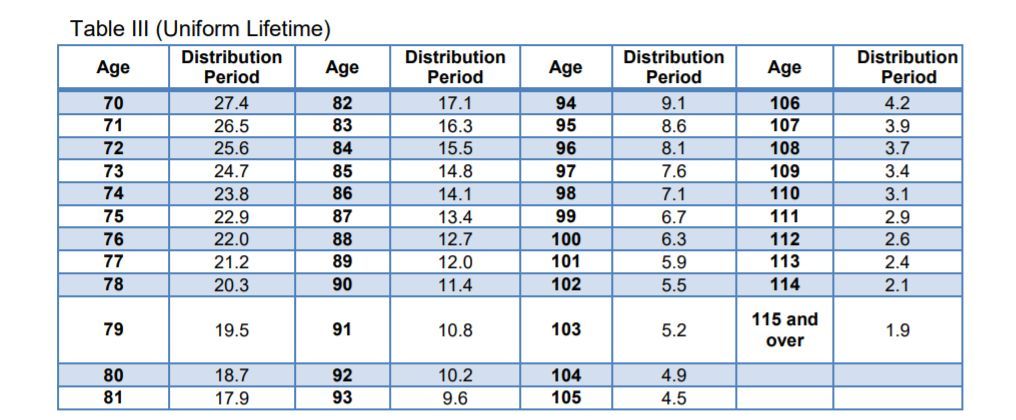

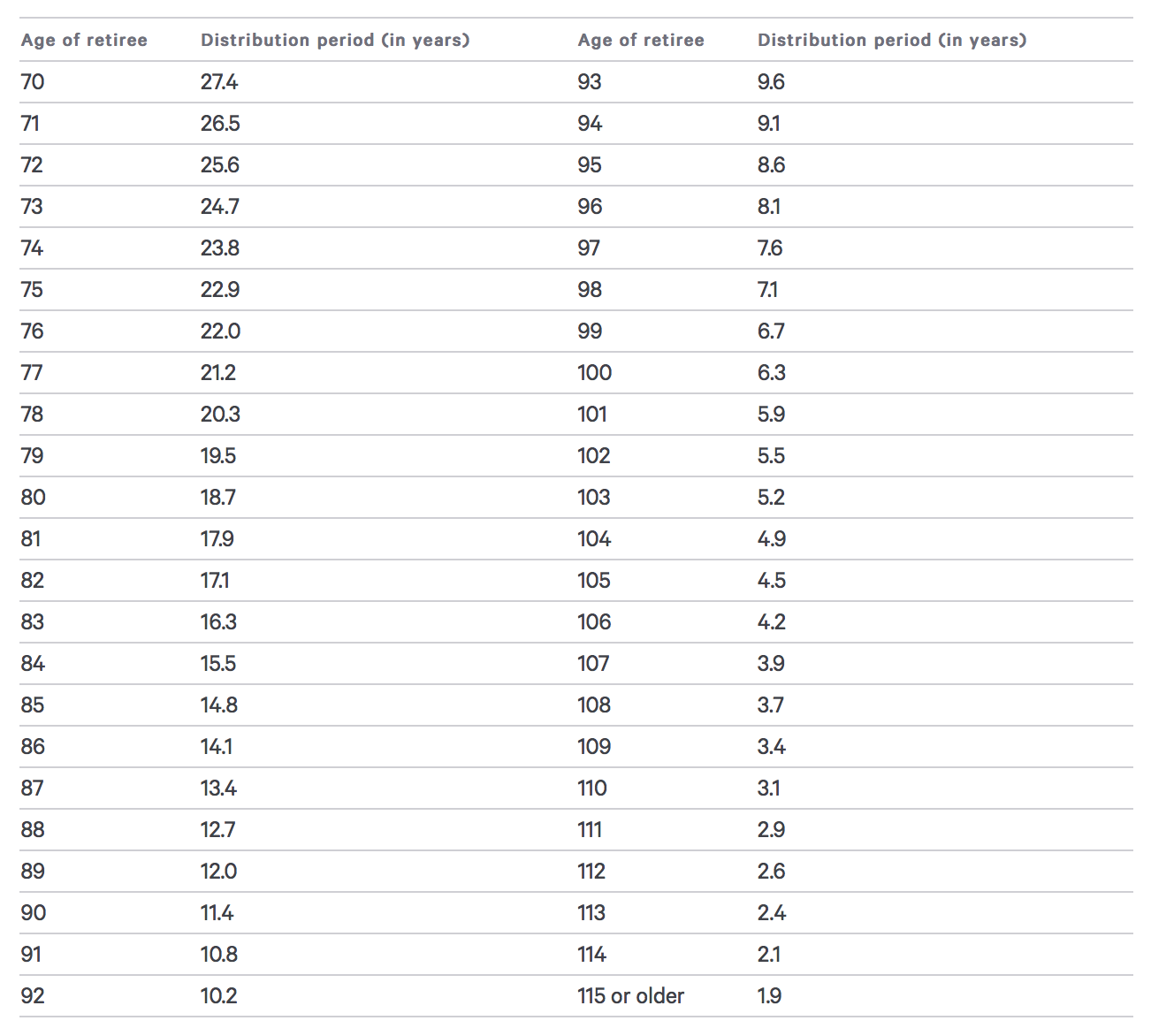

What is the IRS Uniform Lifetime Table?

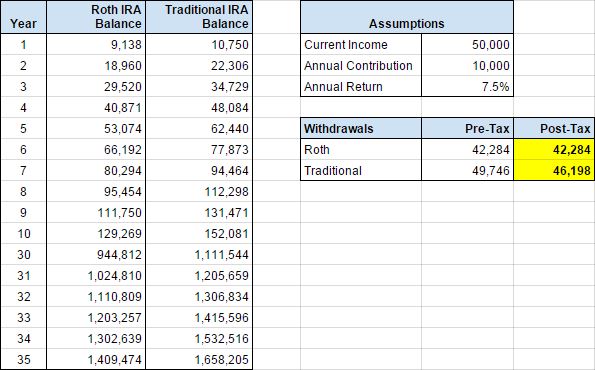

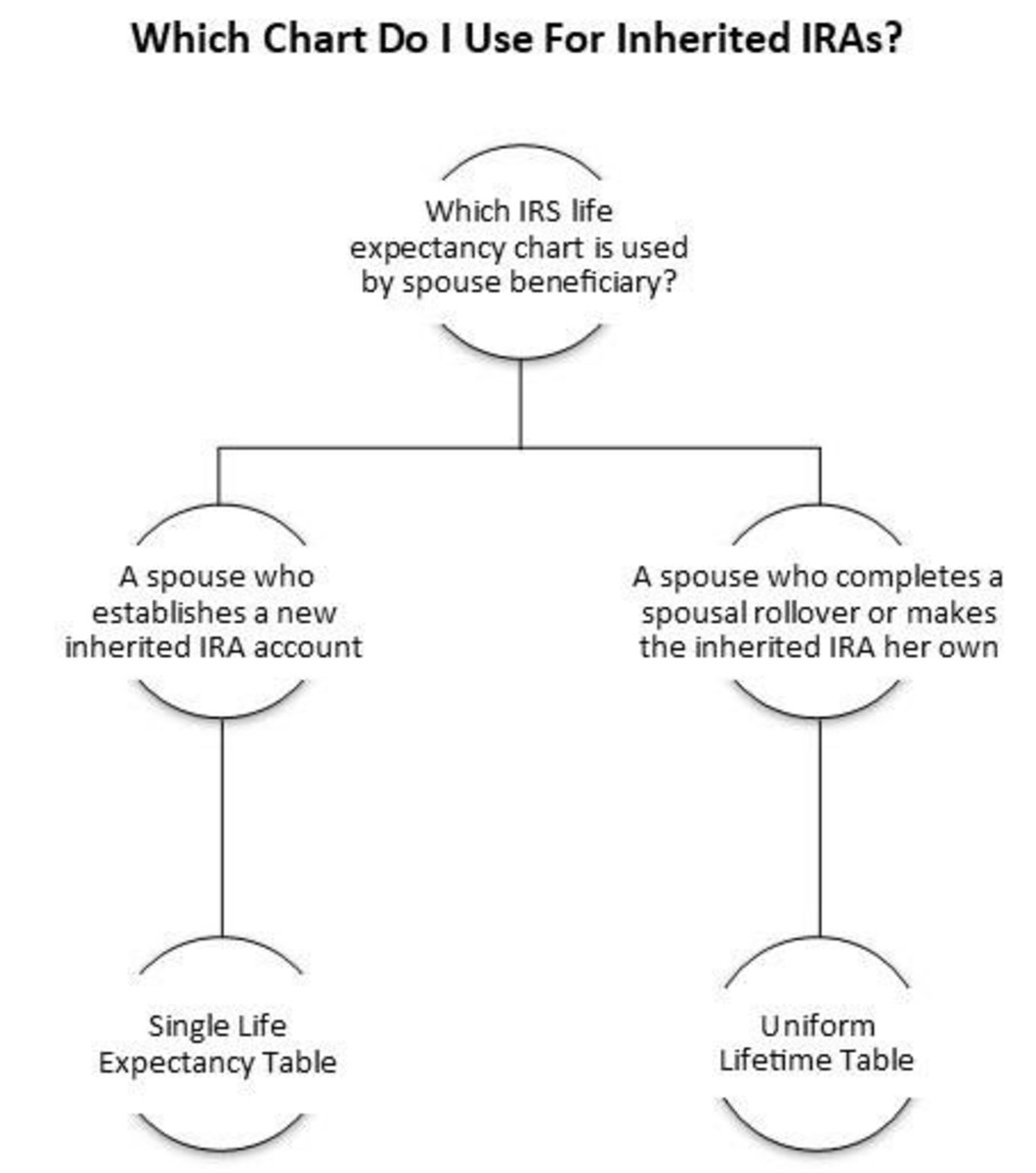

How to Use the IRS Uniform Lifetime Table

PDF IRS Uniform Lifetime Table

You can find the IRS Uniform Lifetime Table in PDF format on the Fidelity website or by visiting the official IRS website. The table is usually updated annually, so it's essential to use the most recent version to ensure accuracy.

Calculating RMDs with Fidelity

Fidelity provides a range of tools and resources to help you calculate your RMDs, including an online RMD calculator. You can also consult with a Fidelity representative or financial advisor to ensure you're meeting your RMD obligations. Understanding the IRS Uniform Lifetime Table is crucial for calculating RMDs and avoiding penalties. By following the steps outlined in this article and using the PDF IRS Uniform Lifetime Table, you can ensure you're meeting your RMD obligations and enjoying a steady income stream in retirement. Remember to consult with a financial advisor or tax professional if you have any questions or concerns about RMDs or the IRS Uniform Lifetime Table.Keyword: Fidelity, IRS, PDF IRS Uniform Lifetime Table, Calculate RMDs

Note: The article is written in a way that is SEO-friendly, with relevant keywords and phrases included throughout the content. The HTML format is used to structure the article, with headings, paragraphs, and links to relevant resources. The article is approximately 500 words in length.