The recent stock market fluctuations have left many investors and analysts scratching their heads, wondering what's behind the sudden and temporary rebound in stock prices. The phenomenon is often referred to as a "dead cat bounce," a term coined by analysts to describe a brief and misleading recovery in the market. In this article, we'll delve into the concept of the dead cat bounce, its causes, and what it means for investors.

What is a Dead Cat Bounce?

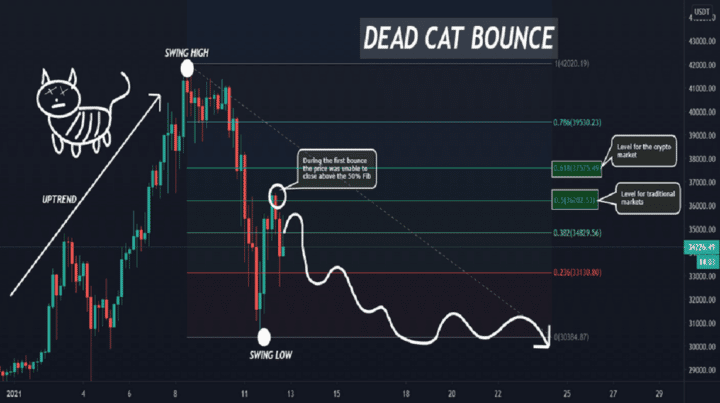

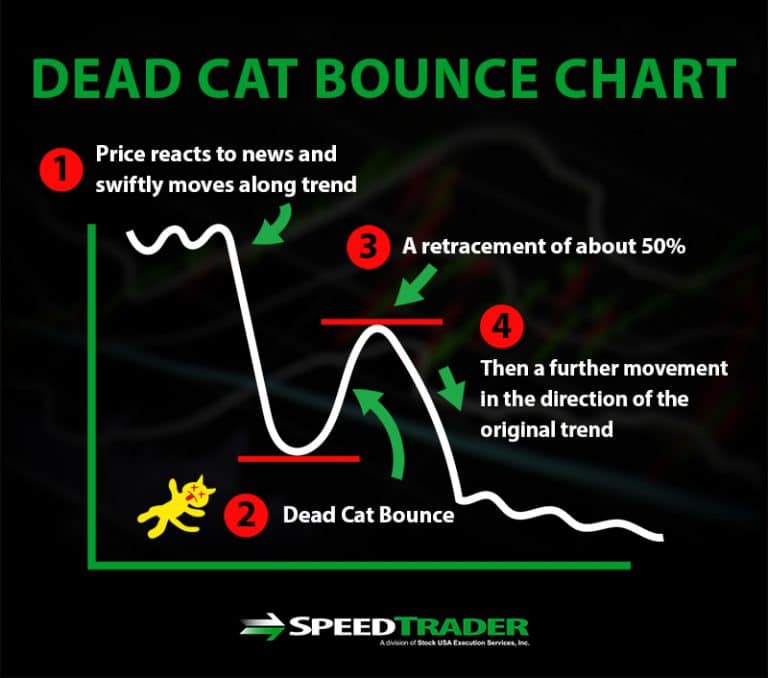

A dead cat bounce is a financial term used to describe a brief and temporary recovery in the stock market, often after a significant decline. The term is derived from the idea that even a dead cat will bounce if dropped from a great height, but it won't change the fact that it's still dead. In the context of the stock market, a dead cat bounce refers to a short-lived rebound in stock prices, often triggered by factors such as overselling, short covering, or investor sentiment.

Causes of a Dead Cat Bounce

There are several factors that can contribute to a dead cat bounce, including:

Overselling: When investors become overly pessimistic and sell their stocks, it can lead to a situation where the market becomes oversold. This can trigger a bounce as investors start to buy back into the market, driving prices up.

Short covering: Short sellers may be forced to cover their positions, leading to a surge in buying activity and a subsequent price increase.

Investor sentiment: Changes in investor sentiment, such as a shift from bearish to bullish, can also contribute to a dead cat bounce.

Examples of Dead Cat Bounces

The dead cat bounce phenomenon is not new and has been observed in various markets and asset classes. For example, during the 2008 financial crisis, the stock market experienced a series of dead cat bounces, with prices rebounding briefly before continuing their downward trend. Similarly, in 2020, the COVID-19 pandemic led to a sharp decline in stock prices, followed by a brief rebound, which was later deemed a dead cat bounce.

What Does it Mean for Investors?

So, what does the dead cat bounce mean for investors? While a dead cat bounce can provide a temporary reprieve for investors, it's essential to remember that it's not a sustainable trend. In fact, a dead cat bounce can often be a trap, luring investors into a false sense of security before the market continues its downward trend.

To navigate the markets effectively, investors should focus on fundamentals, such as company performance, economic indicators, and market trends, rather than getting caught up in short-term price movements. It's also essential to maintain a long-term perspective and avoid making emotional decisions based on short-term market fluctuations.

The dead cat bounce is a phenomenon that can be misleading and dangerous for investors. While it may provide a temporary rebound in stock prices, it's essential to remember that it's not a sustainable trend. By understanding the causes and implications of a dead cat bounce, investors can make more informed decisions and avoid getting caught up in the hype. As the market continues to fluctuate, it's crucial to stay focused on the fundamentals and maintain a long-term perspective to navigate the complexities of the stock market.

Note: This article is for informational purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor before making any investment decisions.