As the new year approaches, it's essential to ensure you have all the necessary documents in order to comply with tax regulations. One crucial form for businesses and individuals is the Federal W-9 form, also known as the Request for Taxpayer Identification Number and Certification. In this article, we'll delve into the details of the printable 2024 Federal W-9 form, its purpose, and how to fill it out accurately.

What is the Federal W-9 Form?

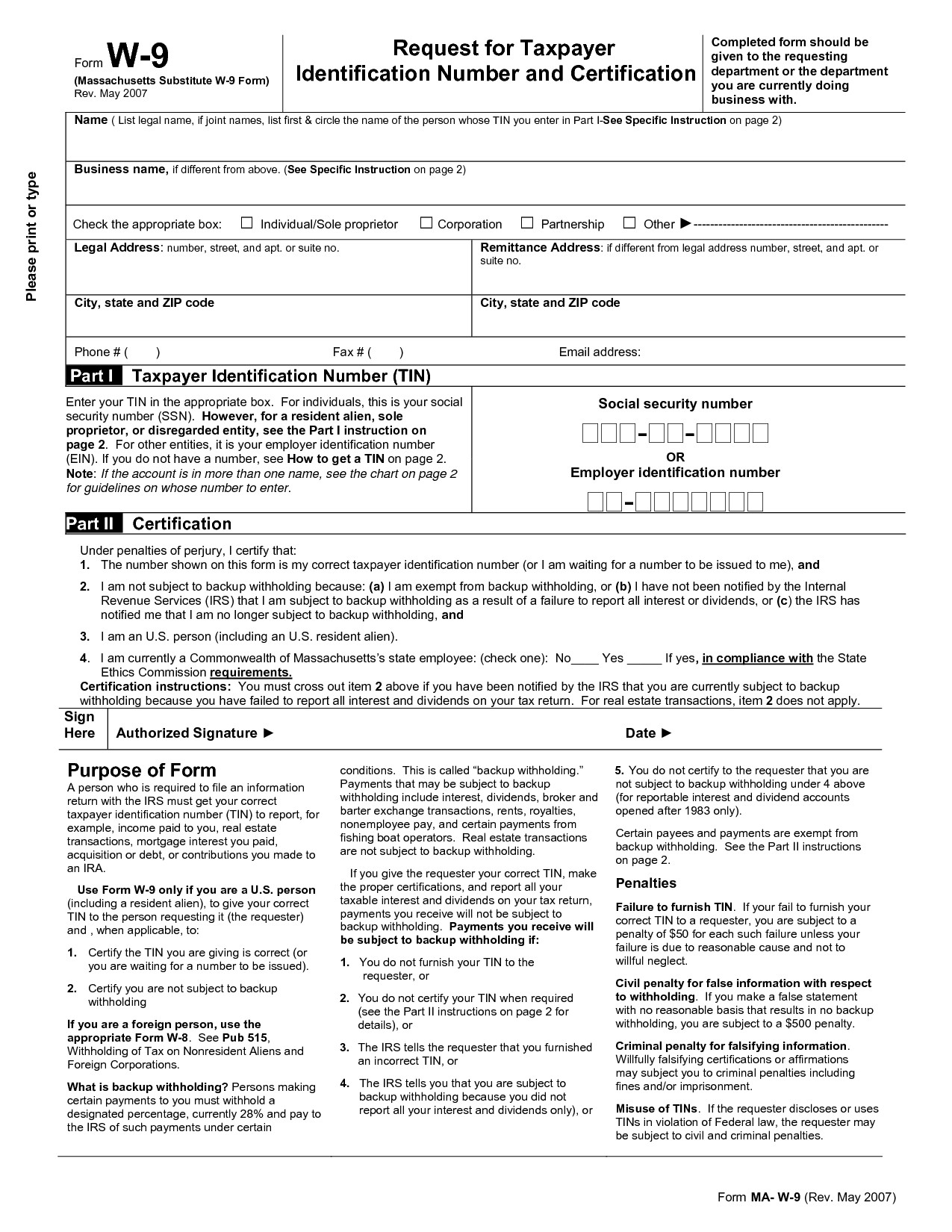

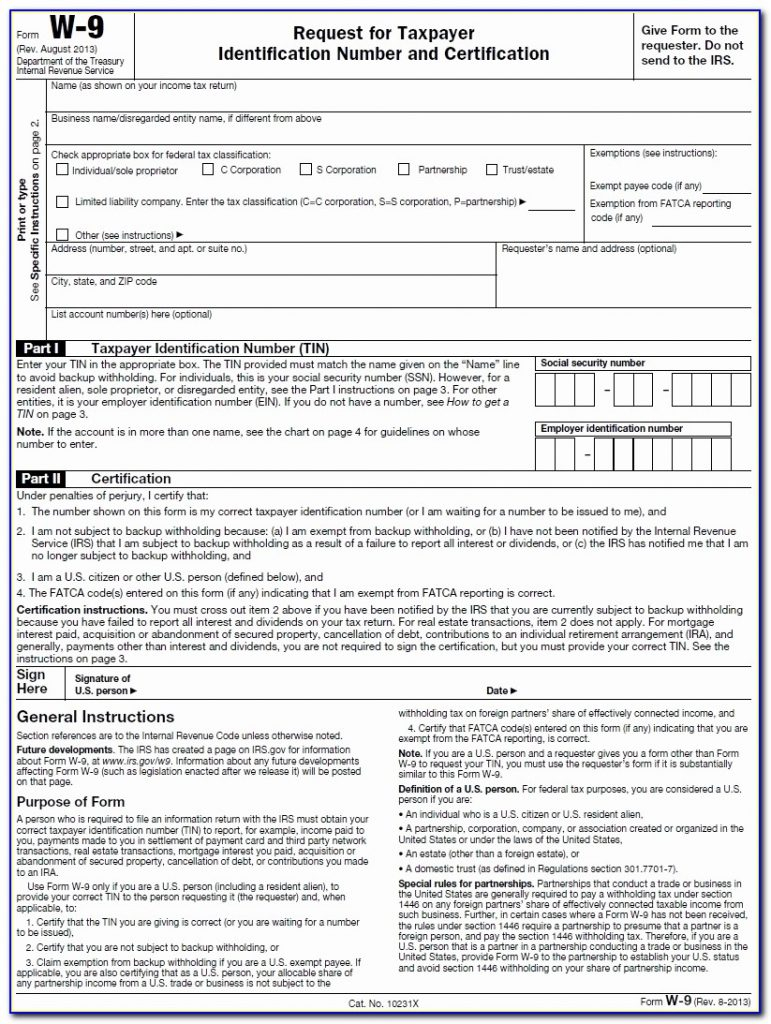

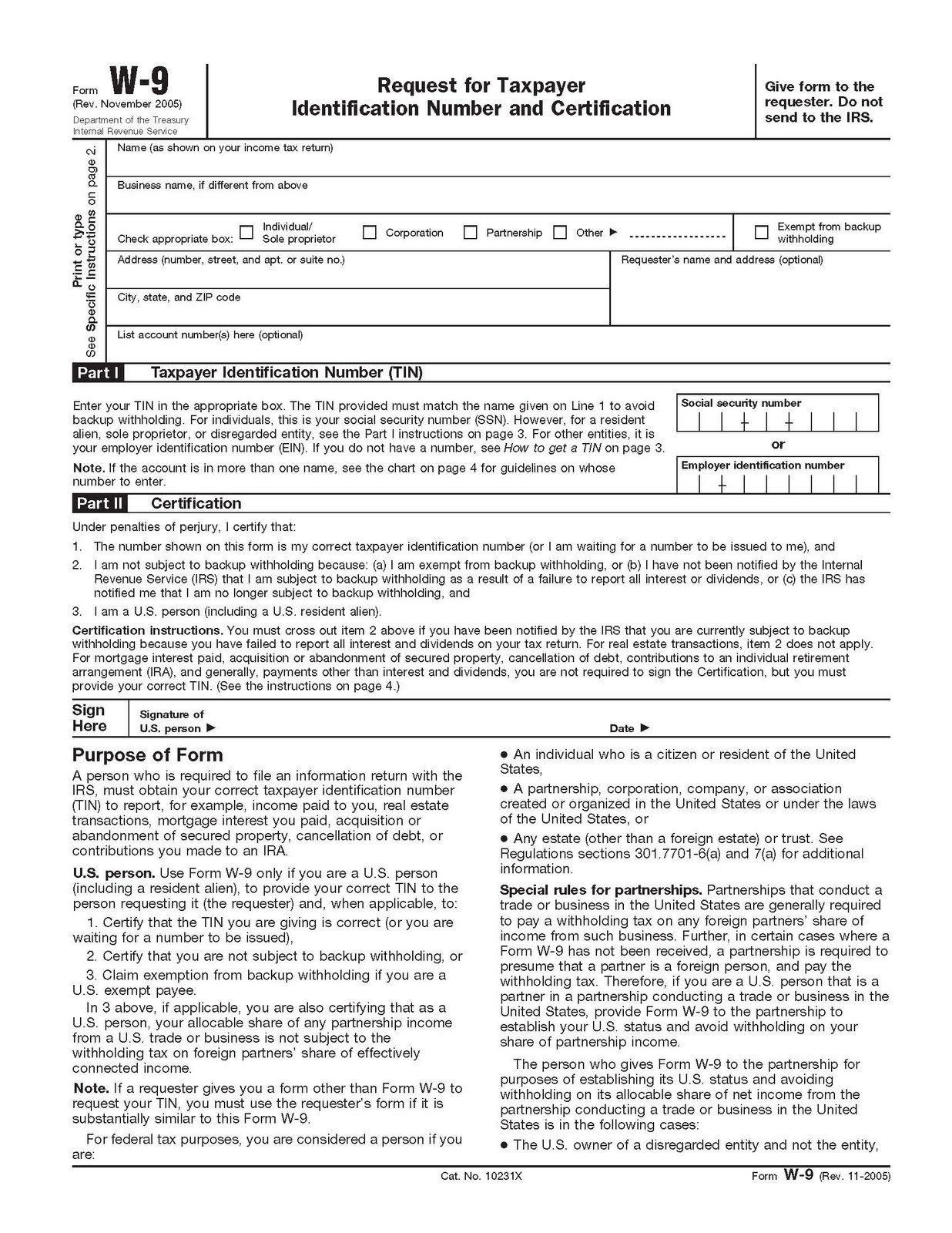

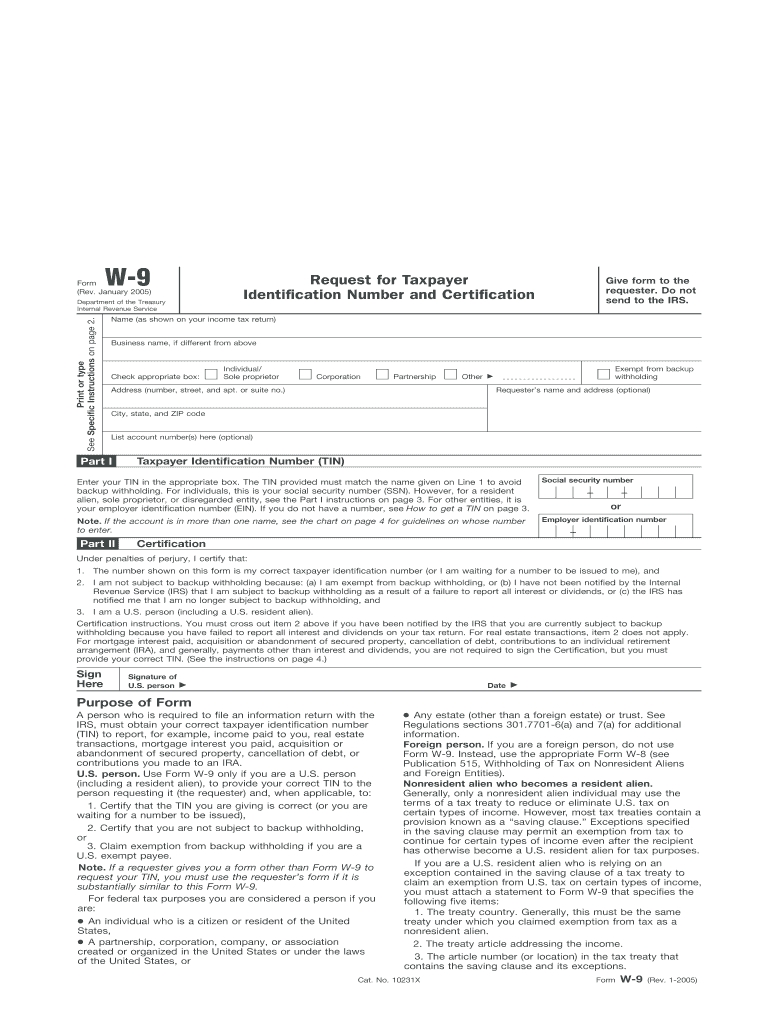

The Federal W-9 form is a document used by the Internal Revenue Service (IRS) to collect taxpayer identification numbers from businesses and individuals. The form is typically required when a business or individual provides services to another company, and it's used to verify the taxpayer's identity and certify their status. The W-9 form is usually requested by payers, such as employers, financial institutions, or other businesses, to ensure they have the correct taxpayer identification number on file.

Purpose of the Federal W-9 Form

The primary purpose of the Federal W-9 form is to provide the payer with the taxpayer's identification number, which is usually their Social Security number or Employer Identification Number (EIN). This information is used to report income paid to the taxpayer on a Form 1099-MISC, which is used to report miscellaneous income. The W-9 form also certifies that the taxpayer is not subject to backup withholding, which is a type of withholding that requires the payer to withhold a portion of the payment and send it to the IRS.

How to Fill Out the Printable 2024 Federal W-9 Form

Filling out the printable 2024 Federal W-9 form is a straightforward process. Here are the steps to follow:

Download the printable 2024 Federal W-9 form from the IRS website or obtain it from the payer.

Fill out the form accurately, providing your name, business name, address, and taxpayer identification number.

Certify your status as a U.S. person (including a resident alien) and acknowledge that you are not subject to backup withholding.

Sign and date the form.

Return the completed form to the payer.

Importance of Accurate Completion

It's crucial to fill out the Federal W-9 form accurately to avoid any delays or issues with your tax reporting. Inaccurate or incomplete information can lead to backup withholding, which can result in a reduction of your payment. Additionally, providing false information on the W-9 form can lead to penalties and fines.

The printable 2024 Federal W-9 form is an essential document for businesses and individuals who provide services to other companies. By understanding the purpose and importance of the W-9 form, you can ensure accurate completion and avoid any potential issues with your tax reporting. Remember to fill out the form carefully and return it to the payer in a timely manner to ensure compliance with tax regulations.

By following these steps and understanding the importance of the Federal W-9 form, you can ensure a smooth and accurate tax reporting process. If you have any questions or concerns about the W-9 form or any other tax-related issues, it's always best to consult with a tax professional or the IRS directly.