Table of Contents

- New Tax Rates Australia 2024 Calculator - Printable Forms Free Online

- Tax Brackets Australia 2024-25 - Wally Malvina

- Australia ranks lowly in highest-taxing nation table | AAP

- Ato Tax Rates 2024 Australia - Printable Online

- Australian income tax brackets and rates (2024-25 and previous years)

- Australian Tax Brackets 2024 Archives - KPG Taxation | Tax Accounting ...

- Australia Income Tax Rate 2024 - Shae Yasmin

- Australian Tax Brackets in 2024 - Tax Basics for Beginners - YouTube

- Income Tax Bracket Change 2024au - Sean Winnie

- New Tax Brackets 2024 Australia - Jody Claretta

Introduction to Personal Income Tax Brackets

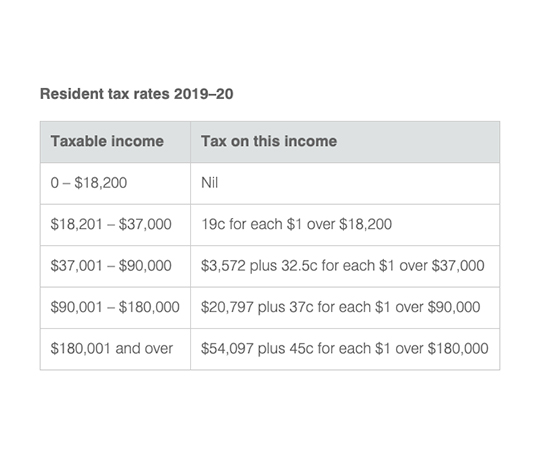

2024-25 Personal Income Tax Brackets

Impact of the Changes

The changes to the tax brackets for the 2024-25 financial year will have varying impacts on different segments of the population. For low and middle-income earners, the adjustments may result in slight reductions in tax liabilities, providing a modest increase in disposable income. However, for high-income earners, the tax rates remain significant, with the top marginal tax rate of 45% applying to incomes over $180,000.

Planning and Compliance

To navigate these changes effectively, individuals should review their financial situation and tax obligations. This includes understanding how their income falls within the new tax brackets and planning accordingly. Utilizing tax deductions and offsets, such as those for charitable donations, medical expenses, and education, can also help in minimizing tax liabilities. Moreover, staying informed about any additional changes or updates from the ATO is crucial for compliance and avoiding potential penalties. The 2024-25 personal income tax brackets in Australia reflect the government's efforts to balance economic growth with social equity. As individuals and families prepare for the new financial year, understanding these tax changes is essential for financial planning and tax compliance. Whether you're a low-income earner looking to maximize your take-home pay or a high-income individual seeking to optimize your tax strategy, being aware of the updated tax brackets is the first step towards a more secure financial future. Stay ahead of the curve by keeping abreast of the latest tax updates and adjustments, and consult with a financial advisor if needed, to ensure you're making the most of your financial situation in the coming year.For the most accurate and up-to-date information, always refer to the official Australian Taxation Office (ATO) website or consult with a tax professional.