Table of Contents

- ISHARES 20 YEAR TREASURY BOND ETF (TLT.O) | Tech Charts

- TLT: Guide To The iShares 20+ Years Treasury Bond ETF ...

- The 20 year Treasury Bond versus the TLT ETF - Which is better for ...

- iShares 20+ Year Treasury Bond (TLT) Stock is the 'Chart of the Day ...

- TLT Stock Fund Price and Chart — NASDAQ:TLT — TradingView

- TLT | L1 Stock Market Analysis

- The 20 year Treasury Bond versus the TLT ETF - Which is better for ...

- iShares Barclays 20+ Yr Treas.Bond (ETF)(TLT): Breakdown and Level ...

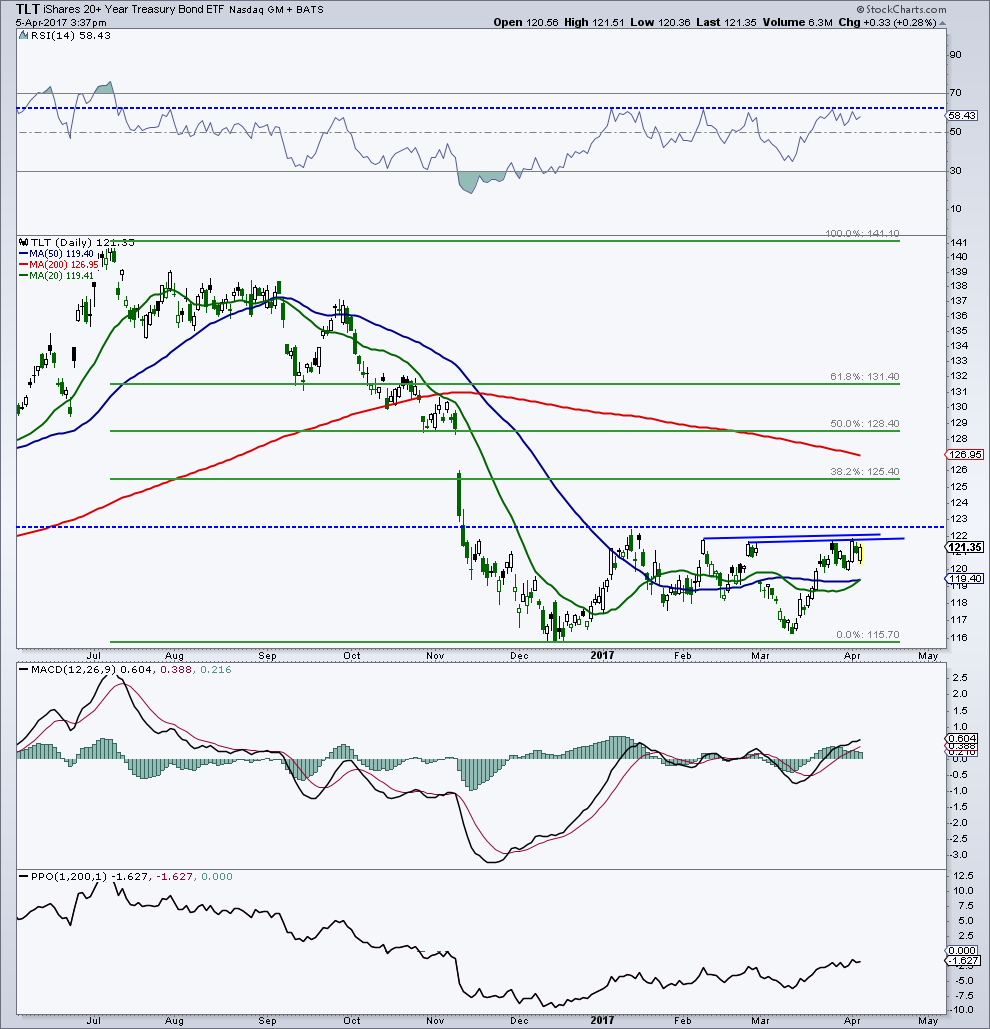

- Treasury Bonds Update (TLT): Bulls Eyeing Key Resistance - See It Market

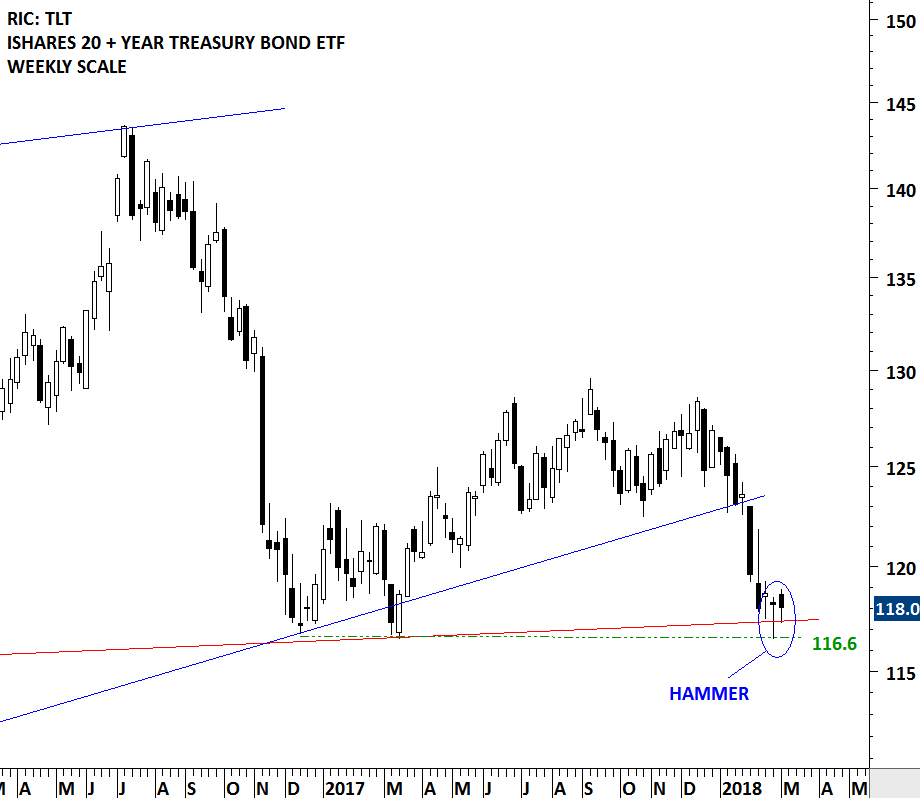

- ISHARES 20+ YEAR TREASURY BOND ETF | Tech Charts

What is the TLT iShares 20+ Year Treasury Bond ETF?

Key Features and Benefits

Investment Strategy and Performance

The TLT iShares 20+ Year Treasury Bond ETF employs a passive investment strategy, seeking to track the performance of the underlying index. The fund's performance is closely tied to the movements of long-term Treasury bond yields, which can be influenced by a range of factors, including monetary policy, economic growth, and inflation expectations. Historically, the fund has provided stable returns, with lower volatility compared to other fixed-income securities. In conclusion, the TLT iShares 20+ Year Treasury Bond ETF offers a unique investment opportunity for those seeking to capitalize on the stability of long-term Treasury bonds. With its low credit risk, regular income, diversification benefits, and flexibility, this ETF can be a valuable addition to a diversified investment portfolio. As with any investment, it is essential to conduct thorough research and consider individual financial goals and risk tolerance before investing. By understanding the features, benefits, and potential uses of the TLT iShares 20+ Year Treasury Bond ETF, investors can make informed decisions and navigate the complex world of fixed-income securities with confidence.For more information on the TLT iShares 20+ Year Treasury Bond ETF, including its current performance, holdings, and investment strategy, please visit the iShares website.