Intel Corporation, one of the world's leading technology companies, has been a staple in the semiconductor industry for decades. As a major player in the global market, Intel's stock price is closely watched by investors and analysts alike. In this article, we'll delve into the world of Intel stock, providing an in-depth analysis of its current price, trends, and future prospects.

Introduction to Intel Corporation

Intel Corporation, listed on the NASDAQ stock exchange under the ticker symbol INTC, is a multinational corporation that designs, manufactures, and sells semiconductor products. Founded in 1968, Intel is headquartered in Santa Clara, California, and is known for its microprocessors, motherboard chipsets, and other semiconductor products. The company is a leader in the development of technologies such as artificial intelligence, 5G, and autonomous driving.

Intel Stock Price Overview

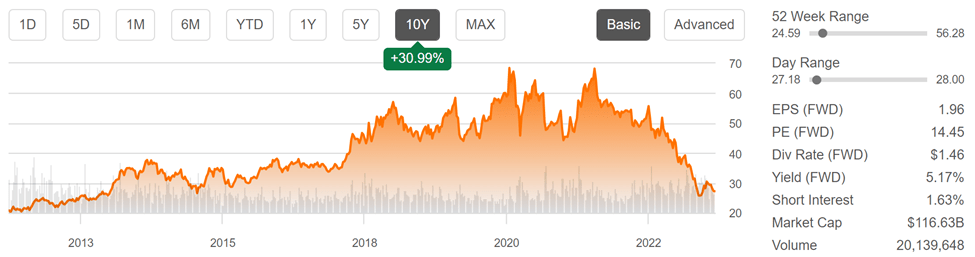

As of the latest market data, Intel's stock price is around $55 per share, with a market capitalization of over $250 billion. The stock has experienced a significant increase in value over the past year, driven by strong demand for the company's products and a robust financial performance. Intel's stock price has been influenced by various factors, including the company's quarterly earnings reports, industry trends, and global economic conditions.

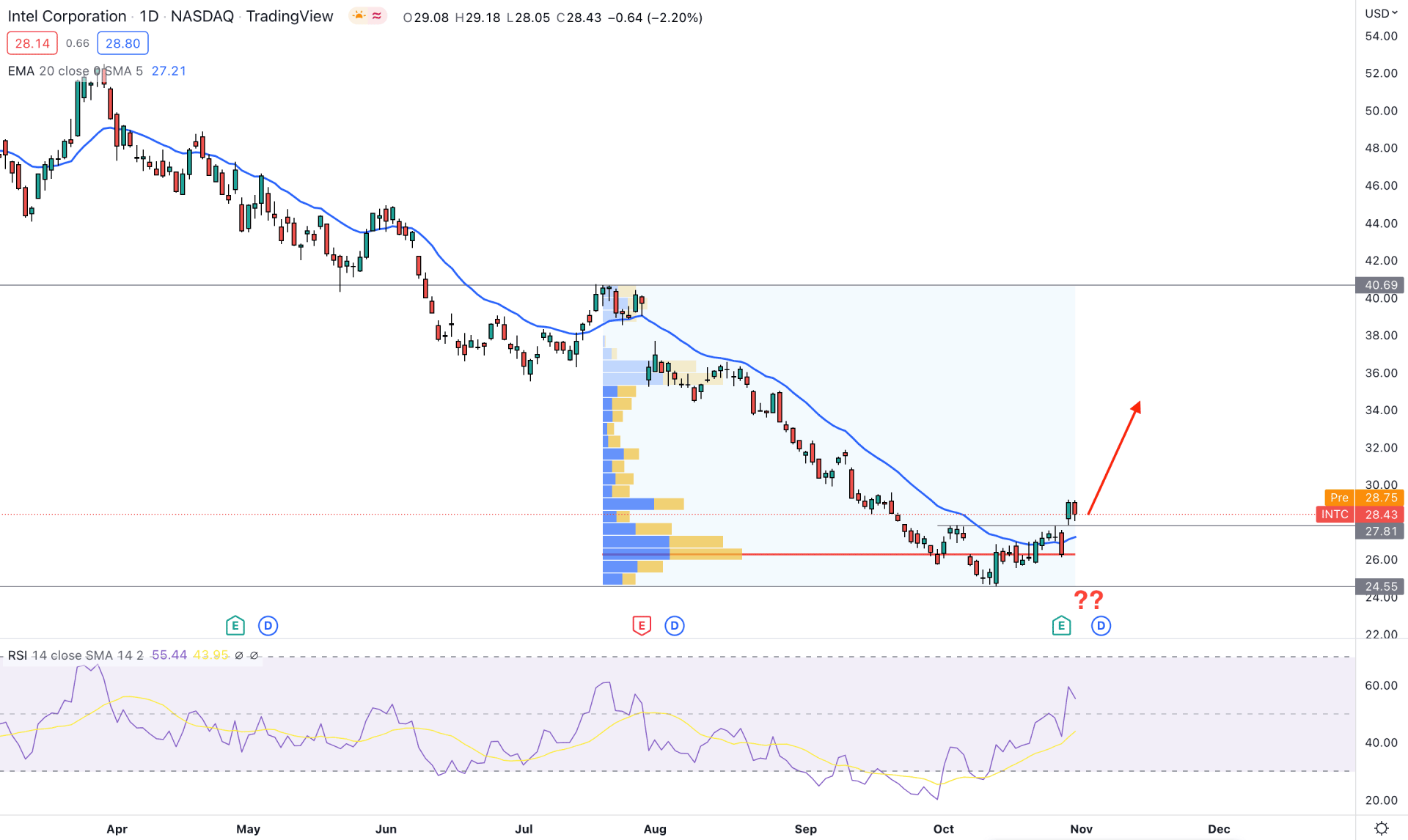

Stock Analysis: Trends and Outlook

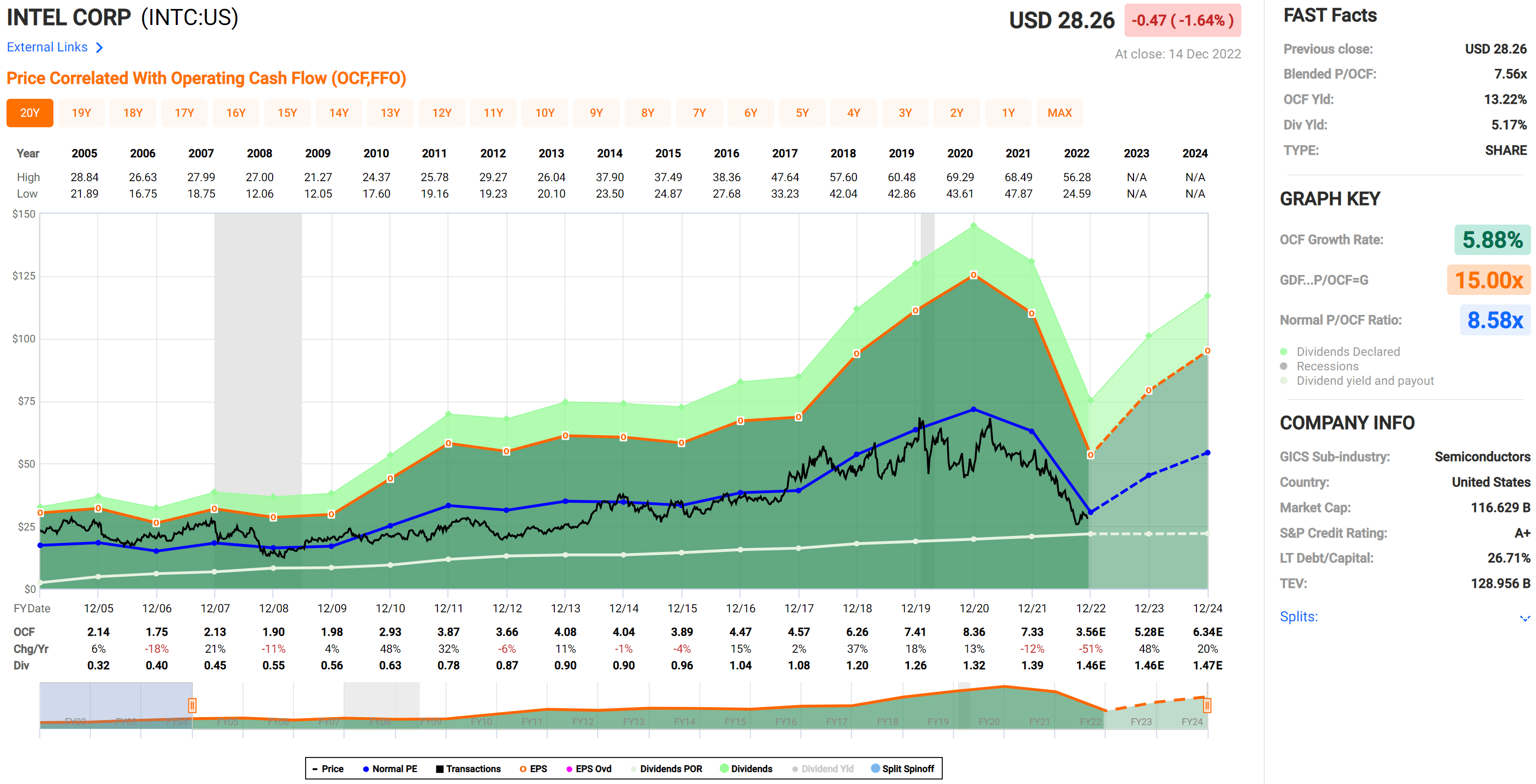

Intel's stock has been trending upwards in recent years, driven by the company's efforts to diversify its product portfolio and expand into new markets. The company's investments in emerging technologies such as AI, 5G, and the Internet of Things (IoT) are expected to drive growth in the coming years. Additionally, Intel's strong financial performance, including a net income of $21.8 billion in 2020, has contributed to the stock's upward trend.

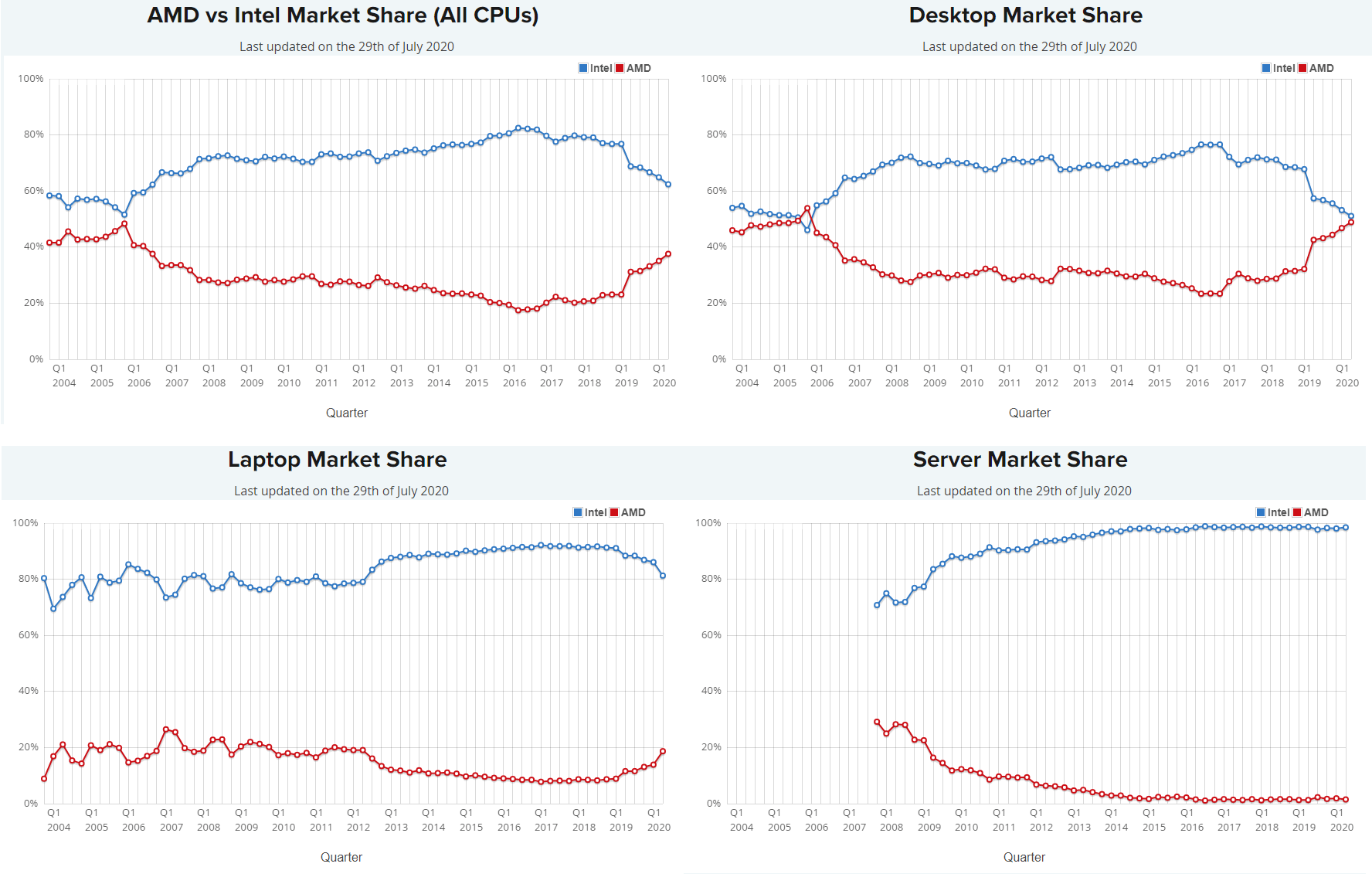

However, Intel faces intense competition in the semiconductor industry, particularly from companies such as AMD and NVIDIA. The company's reliance on a few major customers, such as Apple and Dell, also poses a risk to its revenue and profitability. Furthermore, the ongoing trade tensions between the US and China have impacted Intel's supply chain and revenue.

Key Statistics and Financials

Here are some key statistics and financials for Intel Corporation:

Market capitalization: over $250 billion

Revenue (2020): $72.0 billion

Net income (2020): $21.8 billion

Earnings per share (EPS): $1.42

Dividend yield: 2.04%

52-week high: $69.29

52-week low: $43.63

Intel Corporation is a leading technology company with a strong track record of innovation and financial performance. While the company faces challenges in the competitive semiconductor industry, its diversification efforts and investments in emerging technologies are expected to drive growth in the coming years. As with any investment, it's essential to conduct thorough research and consider multiple factors before making a decision. With its stable financials and promising outlook, Intel stock is definitely worth considering for investors looking to add a technology giant to their portfolio.

Note: The information contained in this article is for general information purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor before making any investment decisions.