Table of Contents

- DAL -- Is Its Stock Price A Worthy Investment? Learn More.

- At What Point Is DAL Stock Going to Be a Screaming Buy? | InvestorPlace

- DAL Stock Price Today (plus 7 insightful charts) • Dogs of the Dow

- Delta Air Lines Stock: Ready For Takeoff (NYSE:DAL) | Seeking Alpha

- Delta Airlines (DAL) Stock - TIME TO BUY!? REBOUND INCOMING!? - YouTube

- DAL Stock Price and Chart — TradingView

- Why Buffett Might Have Made the Right Move Selling Delta Airlines Stock ...

- DAL Stock: Delta Air Lines Has Upside Potential Into Next Year ...

- DAL Stock Price and Chart — NYSE:DAL — TradingView

- Dal stock foto. Image of stapel, ingrediënten, gezond - 63905382

As one of the major players in the airline industry, Delta Air Lines Inc. (DAL) has been a subject of interest for investors and market enthusiasts alike. The company's stock performance has been a topic of discussion, with many wondering if it's a good time to invest in DAL. In this article, we'll delve into the world of Delta Air Lines Inc. stock, exploring its current market trends, financial performance, and future prospects.

Current Market Trends

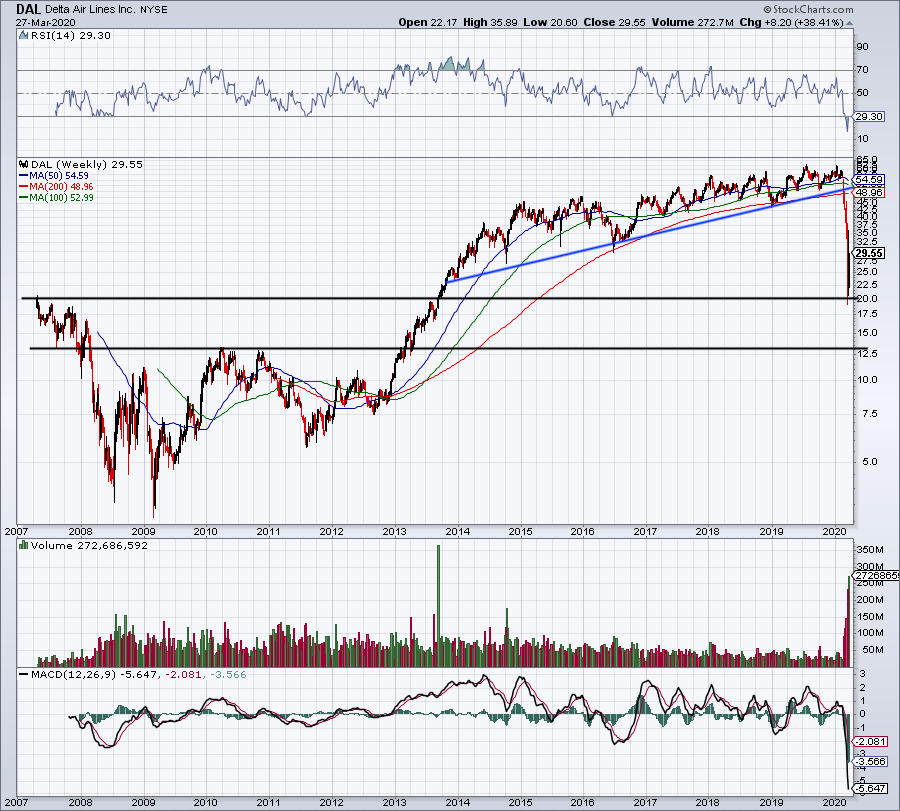

As of the latest market update, Delta Air Lines Inc. stock is trading at around $40 per share, with a market capitalization of over $25 billion. The stock has experienced a significant decline in recent months, primarily due to the COVID-19 pandemic and its impact on the airline industry. However, with the gradual reopening of borders and the vaccination rollout, the stock has started to show signs of recovery.

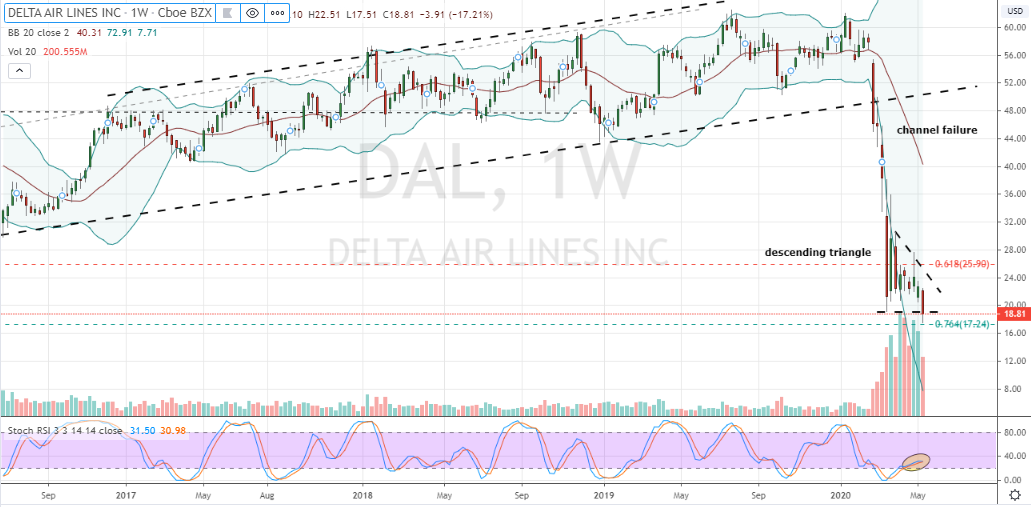

According to Markets Insider, DAL stock has a 52-week high of $62.48 and a 52-week low of $17.51. The stock's beta is 1.16, indicating a moderate level of volatility. The average trading volume is around 10 million shares per day, making it a relatively liquid stock.

Financial Performance

Delta Air Lines Inc. has reported a mixed financial performance in recent quarters. The company's revenue has been impacted by the pandemic, with a decline in passenger demand and revenue passenger miles. However, the company has taken steps to mitigate the impact, including reducing costs, cutting capacity, and implementing cost-saving measures.

In its latest quarterly earnings report, Delta Air Lines Inc. reported a net loss of $12.4 billion, compared to a net income of $1.1 billion in the same quarter last year. The company's operating revenue declined by 66% year-over-year, primarily due to the pandemic. However, the company's cash and cash equivalents increased to $16.7 billion, providing a cushion against future uncertainties.

Future Prospects

Despite the current challenges, Delta Air Lines Inc. has a strong foundation and a robust business model. The company has a loyal customer base, a modern fleet, and a strong network of routes. With the gradual recovery of the airline industry, DAL stock is expected to rebound in the long term.

The company's focus on cost-cutting, capacity discipline, and investments in technology and customer experience is expected to drive growth and profitability. Additionally, the company's commitment to sustainability and environmental initiatives is likely to attract environmentally conscious investors and customers.

In conclusion, Delta Air Lines Inc. stock (DAL) is a complex and dynamic investment opportunity. While the current market trends and financial performance may seem challenging, the company's strong foundation, robust business model, and future prospects make it an attractive investment option for long-term investors. As the airline industry recovers, DAL stock is expected to rebound, making it a good time to consider investing in this major player.

For the latest updates and analysis on Delta Air Lines Inc. stock, visit Markets Insider and stay informed about the latest market trends and news.

Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Always consult with a financial advisor before making any investment decisions.