Table of Contents

- IRS, 2025년 401(k) 및 기타 퇴직 연금 기여 한도 인상 발표 – 시애틀 한인 커뮤니티 | 케이 시애틀

- It's Official: 401(k) Contribution Limits for 2025 Are Here

- 2025 401k Contribution Limit - Karen Fisher

- The NEW 2025 Retirement Plan Contribution Limits! KEY Updates Inside ...

- 2024 Irs 401(K) Income Limits - Astra Candace

- Retirement plans are changing in 2025: What to know - ABC News

- 2025 401k Contribution Max - Emmy Norrie

- IRS Raises 401(k) Contribution Limit for 2025

- 401k Limit 2025 Catch Up - Elset Kalinda

- IRS Releases 2025 Limits for Retirement Plans – Sequoia

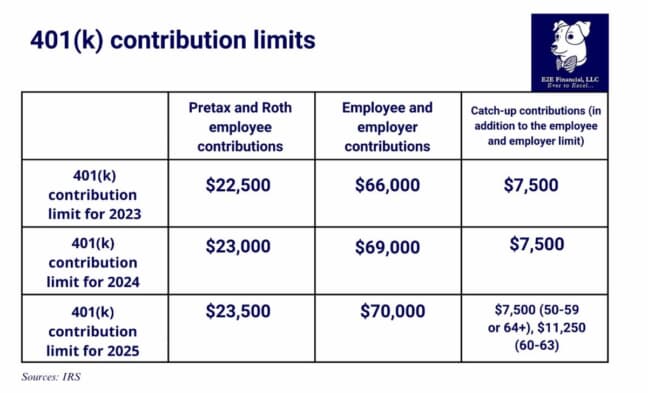

Retirement Plan Contribution Limits

Income Thresholds for Retirement Plan Contributions

Other Fringe Benefit Plan Limitations

The IRS has also released updated limitations for other fringe benefit plans, including health savings accounts (HSAs) and flexible spending accounts (FSAs). For 2025, the annual contribution limit for HSAs has increased to $4,150 for individual coverage and $8,300 for family coverage. The annual contribution limit for FSAs has also increased to $3,100. These updated limitations will affect the amount that individuals can contribute to these accounts, providing a higher savings potential for medical expenses. The 2025 retirement and fringe benefit plan limitations released by the IRS provide essential guidance for individuals and employers. The updated contribution limits, income thresholds, and benefit amounts will affect various aspects of retirement planning, including savings potential, deductibility, and benefit amounts. It is essential to review these updated limitations and adjust your retirement strategy accordingly. By understanding the changes and planning ahead, you can maximize your retirement savings and secure a more comfortable future. Consult with a financial advisor or tax professional to ensure that you are taking advantage of the updated limitations and optimizing your retirement plan.Keyword: IRS releases 2025 retirement and fringe benefit plan limitations

Meta Description: The IRS has released the 2025 retirement and fringe benefit plan limitations, affecting contribution limits, income thresholds, and benefit amounts. Learn more about the updates and how they impact your retirement strategy.

Header Tags: H1, H2

Word Count: 500